By Pelumi Salako

On February 5, 2021, The Central Bank of Nigeria released a circular that restricts Nigerian banks, non-banking financial institutions and other financial institutions from dealing in cryptocurrencies or facilitating payments for cryptocurrency exchanges, with the promise of severe regulatory sanctions for those who fail to comply with the directive.

“All DMBs, NBFIs and OFIs are directed to identify persons and/or entities transacting in or operating cryptocurrency exchanges within their systems and ensure that such accounts are closed immediately,” the circular states. The cryptocurrency ban was devastating for many Nigerians, who voiced their alarm on social media.

Economist Nonso Obikili tweeted, “How important is crypto in Nigeria? On binance today the value of BTC/NGN trades was worth N13.4bn. For context the volume of trade on the Nigerian stock exchange today was N5.6bn. And Binance is just one exchange.” Another user, Fakkhriyah Hashim, tweeted, “The CBN directive to ban Crypto transactions is outrageous. There are so many young people innovating, creating so much despite the hostility of the Nigerian government. This is an assault on all those staking so much in investing themselves in Nigeria.”

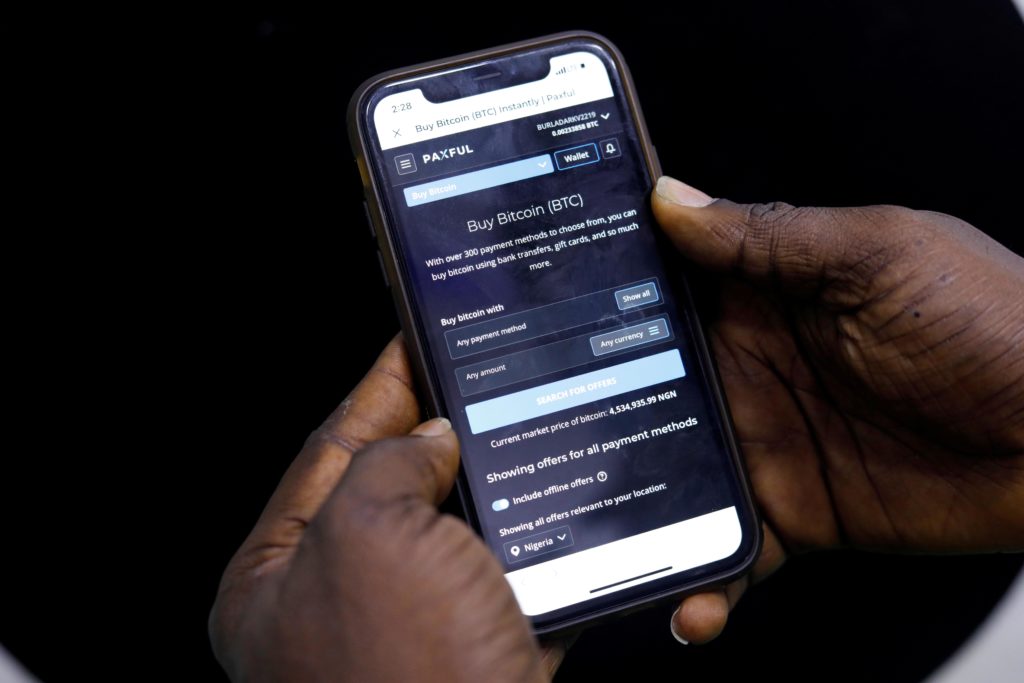

According to the crypto marketplace Paxful, Nigeria is the world’s second-largest bitcoin user by trading volume, and has traded 60,215 bitcoins (valued at over $566 million) in the last five years. Nigeria is Africa’s biggest cryptocurrency market. Last year, BuyCoins estimated that the total volume of bitcoin traded in Nigeria was $200 million per month.

The crypto ban means that local fintech companies must consider new ways to continue business. “We are fully aware of the newest CBN circular and are going to be working with regulators to ensure our services are compliant. All trading on our platforms continues as usual, and all user funds are safe,” a statement on BuyCoin’s Twitter page says. Binance announced that it has suspended deposits from Nigerian users.

Franklin Peters, the CEO of Bitfxt, said that the ban took his company by surprise. “For my company, it came as a blow because we didn’t expect it. We were supposed to unveil one of our new applications which depended heavily on our financial partners. It really affected us because we have spent a lot of money to build it to that point, only for it to meet the community dead on arrival,” Peters told Sahelien.com.

Nigerian economist Olayinka Osola said that the ban will affect the country’s economy in myriad ways, starting with the loss of jobs and partnerships that contribute significantly to the economic growth. “Crypto exchange platforms work with the banks because they cannot hold money. These guys pay taxes and if they go out of work they will not be able to do that any longer and this will affect our Gross Domestic Product. If things get bad and companies have to lay off their workers, there will be a ripple effect,” Osola explained.

The ban could also lead to inflation of the naira, he asserted. “With the peer-to-peer system, there will be a lot of cash outflow from the country which will significantly bring down the bank’s cash reserve. I am sure the bank will not want to accept this. There may also be inflation because a lot of Naira will be leaving the country. Maybe they do not see it yet but it is clear enough that these things are going to happen,” Osola said.

Many governments around the world are implementing plans that embrace cryptocurrency. Just one week ago, the Ukranian government announced its plan to build a bitcoin mining center that would help utilize Ukraine’s nuclear power, increase Energoatom’s profits, and help grow the government’s tax purse. Countries like the United States have included cryptocurrency in their tax returns.

One reason the Nigerian government has cracked down on cryptocurrency instead of promoting it is to stifle dissent. Last October, during the #EndSARS protests, donations were received through bitcoins when the CBN suspended organizers’ accounts and other local payment platforms. This move was a key part of the government’s bid to quash the demand for an end to the excesses of the notorious Special Anti-Robbery Squad (SARS) of the Nigerian Police Force.

Some believe that the federal government’s inability to defeat donations sourced through cryptocurrency may have been a motivating factor in putting out this new directive. Lawyer Michael Adeyemi Adú explained that “the government does not embrace cryptocurrency because they have no power to control prices and its use.”

The CEO of Bitfxt, Franklin Peters, said that his company is now considering getting registered in “welcoming countries” and is also actively seeking new ways to restore convenient operation on their platform. As of February 10, 2020, Bitfxt’s corporate accounts have been wiped and closed by their host bank.

For a lot of Nigerians plagued with the nightmare of poverty and unemployment, cryptocurrency trading has become a source of financial freedom. Some rely on it as their primary source of income while others gain passive pay through it. For business owners, it has served as a hedging tool, and some freelancers get paid through cryptocurrency.

Oluwatosin Ayodele, a 23-year-old freelance writer told me that he has made more with cryptocurrency in comparison to fiat currencies. “Two years ago, I recognized the use of cryptocurrency, especially bitcoin, as a better payment option because it offers better rates rather than other direct-to-account payment options. The fact that the other mediums have limitations and lower rates made bitcoin a catch. Cryptocurrency especially affords me a fast payment processing in case of emergencies.”

“I do not know how I will go about it from here because I have sort of gotten used to the juicy rates and investment opportunities crypto provides. There were sites I sold to and they paid automatically into my account because there is a symbiosis with the traditional banks. With that gone, I wonder how I’ll manage to exchange crypto to Naira now. There is no justification for this policy and it feels like bullying,” Ayodele said. “As a young creative, I feel the Government is against me.”

Moses Akanbi, a young crypto trader who buys and sells varieties of coins, has been able to support his family and friends through the profit he makes on his daily trading. He invested in farming through his trading gains, and asserted that traders in Nigeria would find a way to make things work even with the government ban. “Crypto has literally been my life support. I was down by one to life but it gave me a leverage. Crypto currency cannot be banned here. We are the giants of crypto in Africa. We will definitely find a way around it.”